India launches Account Aggregator to extend financial services to millions

- In Economics

- 05:48 PM, Sep 10, 2021

- Myind Staff

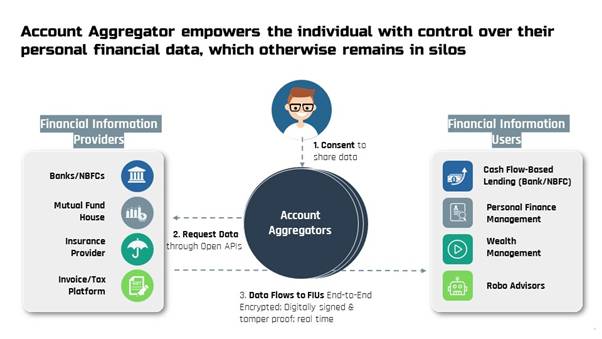

India unveiled the Account Aggregator (AA) network, a financial data-sharing system that could revolutionize investing and credit, giving millions of consumers greater access and control over their financial records and expanding the potential pool of customers for lenders and fintech companies.

Account Aggregator empowers the individual with control over their personal financial data, which otherwise remains in silos.

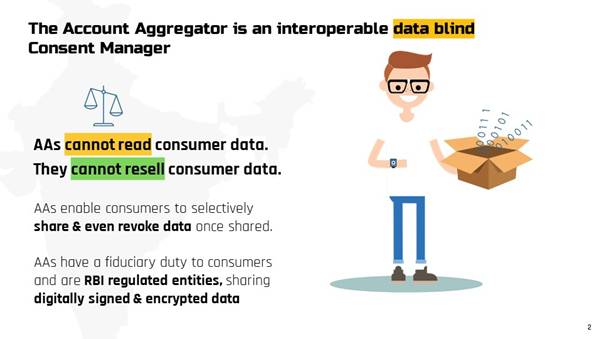

An Account Aggregator (AA) is a type of RBI regulated entity (with an NBFC-AA license) that helps an individual securely and digitally access and share information from one financial institution they have an account with to any other regulated financial institution in the AA network. Data cannot be shared without the consent of the individual. There will be many Account Aggregators an individual can choose between.

Account Aggregator replaces the long terms and conditions form of ‘blank cheque’ acceptance with a granular, step by step permission and control for each use of your data.

The Account Aggregator system in banking has been started off with eight of the India’s largest banks. This can make lending and wealth management a lot faster and cheaper.

The Account Aggregator network would replace all these with a simple, mobile-based, simple, and safe digital data access & sharing process. This will create opportunities for new kinds of services – for example, new types of loans.

The individual's bank just needs to join the Account Aggregator network. Eight banks already have -- four are already sharing data based on consent (Axis, ICICI, HDFC, and IndusInd Banks) and four are going to be able to shortly (State Bank of India, Kotak Mahindra Bank, IDFC First Bank, and Federal Bank).

Gradually the AA framework will make all financial data available for sharing, including tax data, pensions data, securities data (mutual funds and brokerage), and insurance data will be available to consumers. It will also expand beyond the financial sector to allow healthcare and telecom data to be accessible to the individual via AA.

However, Account Aggregators cannot see the data; they merely take it from one financial institution to another based on an individual's direction and consent. Contrary to the name, they cannot 'aggregate' your data. AAs are not like technology companies which aggregate your data and create detailed profiles of you.

The data AAs share is encrypted by the sender and can be decrypted only by the recipient. The end to end encryption and use of technology like the ‘digital signature’ makes the process much more secure than sharing paper documents.

Today, four apps are available for download (Finvu, OneMoney, CAMS Finserv, and NADL) with operational licenses to be AAs. Three more have received in principle approval from RBI (PhonePe, Yodlee, and Perfios) and may be launching apps soon.

The new two services that a customer can access if their bank has joined the AA network of data sharing includes- the access to loans and access to money management.

If a customer wants to get a small business or personal loan today, there are many documents that need to be shared with the lender.

This is a cumbersome and manual process today, which affects the time taken to procure the loan and access to a loan. Similarly, money management is difficult today because data is stored in many different locations and cannot be brought together easily for analysis.

Through Account Aggregator, a company can access tamper-proof secure data quickly and cheaply, and fast track the loan evaluation process so that a customer can get a loan.

Also, a customer may be able to access a loan without physical collateral, by sharing trusted information on a future invoice or cash flow directly from a government system like GST or GeM.

Image source: PIB

Comments